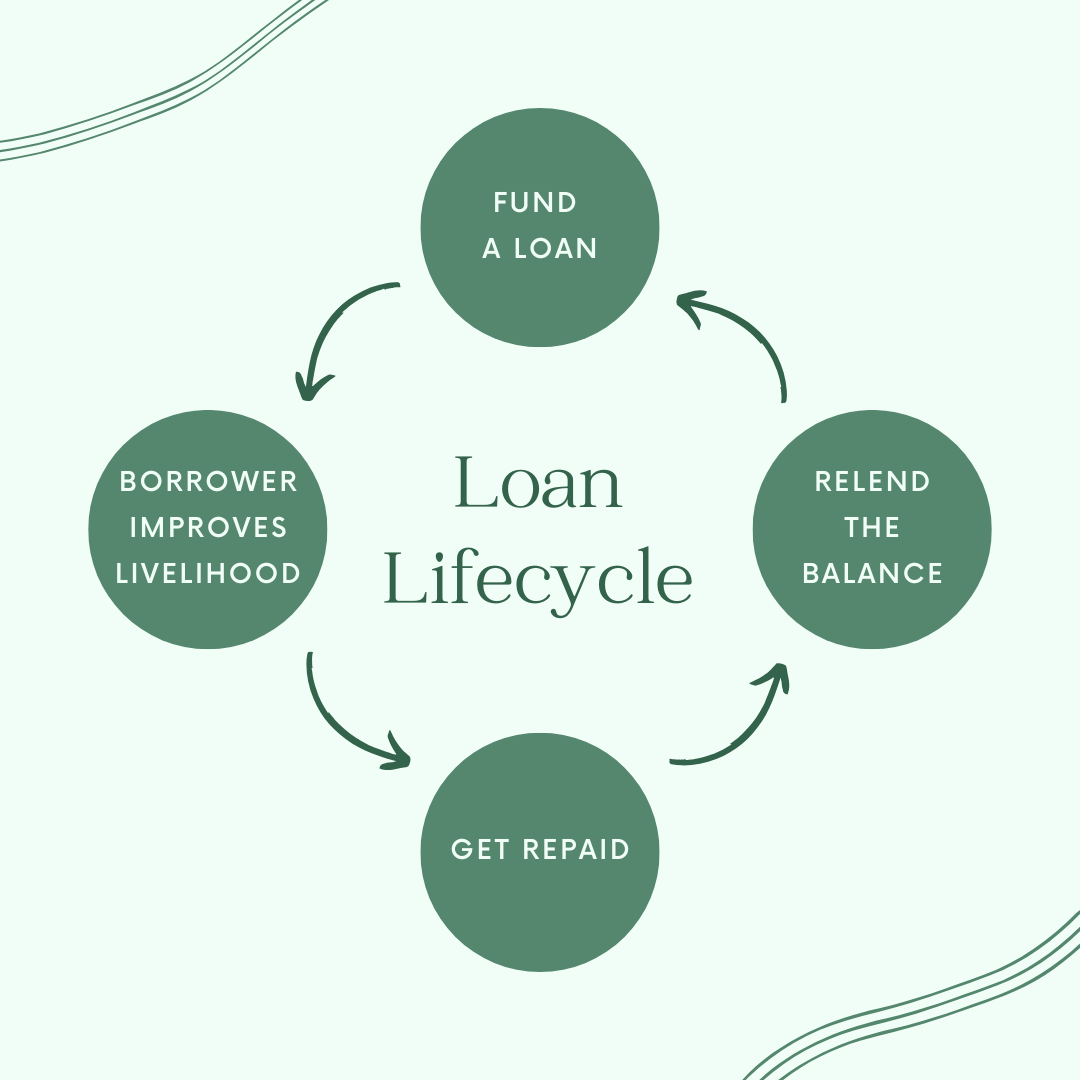

How does re-lending Work?

A loan lifecycle shows that your money makes a difference with the intent that it will always return to you. Kiva loans typically start at $25, but you can lend more if you prefer. You can also contribute to a loan alongside other lenders (us), meaning each loan can be funded by many individuals. By lending through Kiva, you are helping to create a world where opportunity is available to everyone, regardless of where they live or their financial situation. Every loan you make is a step toward building a more equitable and sustainable future.

Why Kiva?

Empowering People: Kiva’s lending model gives people the chance to take charge of their own future, providing access to capital that might otherwise be unavailable through traditional financial systems.

Global Reach: Kiva has made it possible for people from all over the world to support borrowers in over 80 countries, helping to create positive change on a global scale.

Low-Interest, High Impact: Kiva loans typically have low or no interest rates, ensuring that borrowers are not burdened with high repayments. This allows individuals to focus on growing their businesses and improving their lives.

Impact and Sustainability: Because Kiva loans are repaid over time, the funds can be recycled and used again to help other borrowers. This creates a sustainable, ongoing cycle of giving and receiving.

-

Clara Shum

FOUNDER

Clara is a sophomore at Piedmont High School and takes pride in her love of baking, cooking, hospitality and teamwork. Clara is the president of Kiva club in her high school and enjoys being on her school’s track team. Driven by the belief that financial inclusion is a key driver of social change, Clara established KPI with a mission to allow support and resources that enable small businesses and marginalized individuals, to thrive.

-

Amalia Gray

CO-FOUNDER

Amalia is a sophomore at Piedmont High School and enjoys running, baking and being on her school’s cross country and track team. Amalia is also the vice president of Kiva club in her high school. She is venturing on to become a co-founder of KPI with the drive and vision of equal opportunity for those less fortunate. She hopes to help empower under sourced families and use the resources given by her community to better impact a better future for all.

-

Sonia Low

BOARD MEMBER

Sonia Low serves as the Vice President, General Counsel, Corporate Secretary, and Ethics Officer at the Jacob K. Javits Convention Center in New York City, where she oversees all legal and governmental affairs, including corporate governance, ethics, litigation management, commercial transactions, and regulatory compliance.

Before joining the Javits Convention Center, Sonia was the General Counsel for The ONE Group Hospitality, Inc., a publicly traded global hospitality company known for its STK® brand and, later, the iconic Benihana® restaurant brand. In this role, she advised the board, executive team, and employees, managing the company’s legal matters across its subsidiaries.

Sonia began her legal career at LeBoeuf, Lamb, Greene & MacRae LLP, where she specialized in capital markets, mergers and acquisitions, and corporate governance. She later held in-house roles at Credit Suisse and ADP, focusing on securities law, regulatory compliance, and corporate risk management.

She also served as the first General Counsel of the Chinese-American Planning Council, Inc. (CPC), the largest nonprofit Asian American social services organization in the U.S. This role underscores her commitment to supporting underserved communities, as she advanced initiatives that provide essential services and advocacy.

A New York City native and Bronx Science alumna, Sonia earned her J.D. from Brooklyn Law School, where she was a merit-based scholarship recipient and managing editor of The Journal of International Law. She also holds a B.A. from Columbia University.

-

Julia Yong-hee Park

BOARD MEMBER

Julia Yong-hee Park is the Principal Attorney of the Law Offices of Julia Park, LLC, where she specializes in immigration law with a focus on the EB-5 Immigrant Investor Visa program.

She oversees EB-5 Immigrant Investor Program projects, which offer foreign investors a pathway to U.S. residency through job-creating investments that drive economic growth.

Julia is also the Founder and Executive Director of the New Day Program, a day program in Norwood, New Jersey, supporting young adults 21 and older with intellectual disabilities. Launched in August 2021, the New Day Program is part of New Beginning for Special Needs, a 501(c)(3) nonprofit organization founded in 2016 by parents dedicated to enhancing the lives of their children with special needs.

Before entering the legal field, Julia was a simultaneous interpreter in Seoul, Korea, facilitating communication at over 400 seminars and conferences for international organizations and major corporations like the WTO, OECD, and IBM. She has interpreted for prominent figures, including former U.S. President Bill Clinton, Treasury Secretary Robert Rubin, and corporate leaders such as Lou Gerstner of IBM and Jeffrey Katzenberg of DreamWorks Animation. Julia was also the youngest adjunct professor at the Graduate School of Interpretation & Translation at Hankuk University of Foreign Studies in Seoul.

Julia earned her B.A. from Sogang University and an M.A. from Hankuk University of Foreign Studies, both in Seoul, Korea. She received her J.D., magna cum laude and Order of the Coif, from Boston College Law School, where she was a Senior Editor of the Boston College Law Review.

FAQs

-

Kiva partners with microfinance institutions, nonprofits, and other organizations to disburse loans in the communities we serve. We choose partners who have fair, non-predatory lending practices and prioritize social good. This means through Piedmont Kiva Initiative we use the donation and fundraising money and send it to Kiva Organization which they send through their lending partners.

-

Kiva never takes fees from lenders or borrowers. As a 501(c)(3), Kiva relies on donations, grants, and fees from certain lending partners to cover operational costs. Through Piedmont Kiva Initiative we rely on the donations and fundraising we get in order to give money to the Kiva Organization

-

Most borrowers do pay interest to local lending partners to help cover their operation costs. We verify that these rates are appropriate for the region. Individual lenders don't earn interest—and 100% of money you lend goes to supporting borrowers.

-

Yep—Kiva loans really work, and often lead to improved financial wellbeing for borrowers. One study from a Kiva lending partner in Kenya found that farmers saw a 40% rise in income after receiving their Kiva loan!